dEquity's 2023 International Buyers Report: Trends in Real Estate and Real-World Assets

Summarising the past year. Market projections and perspectives for 2024

At dEquity, our main mission is to provide easy access to the cash flow generated by Miami real estate utilising blockchain technology. In other words, we simplify investing in real estate making it available for everyone starting with just a few clicks and only 100$ as a starting capital. Summarising the past year, we prepared an insightful analysis of Miami Real Estate international buyers report. In this article, we’d like to share the most interesting insights, for more detailed analytics please read our full report here.

Our report is focused on the active buyer Miami real estate market, offering clear insights into pricing, trends, and forecasts. Crafted from data sourced from the MIAMI Association of Realtors, the largest local Realtor® association in the U.S., our report, conducted through an online survey and the dEquity research team with responses from nearly 60,000 real estate professionals, corrects biases and maintains a 2% margin of error.

Outstanding Miami Real Estate Market Performance

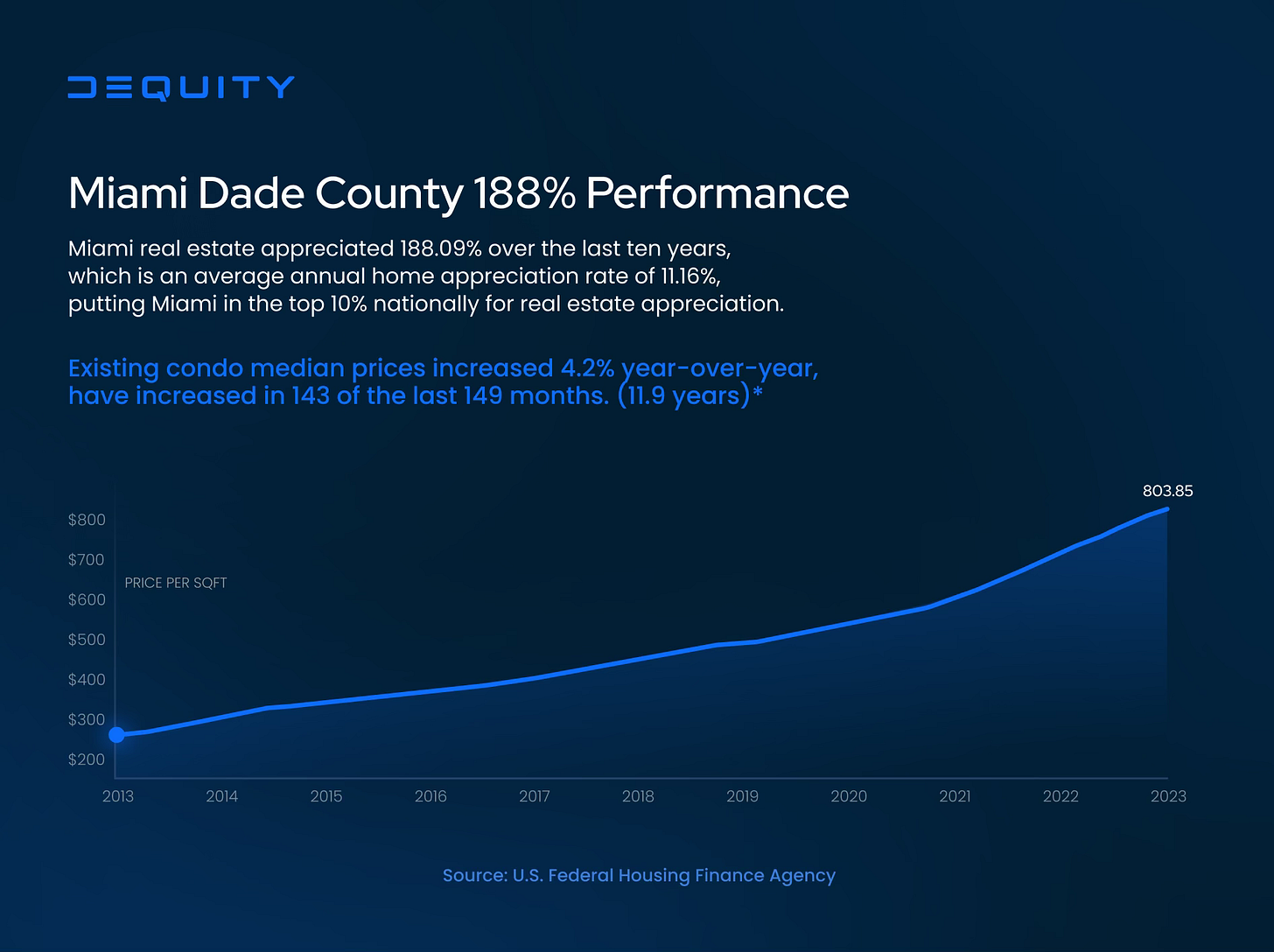

Over the past decade, Miami’s property values have strongly increased, with an average annual appreciation rate of 11.16% - placing Miami among the top 10% in the nation for property appreciation.

The graph below showcases the outstanding 188% performance of Miami Dade County's real estate market over the last 10 years. This data illustrates substantial investor interest in Miami's real estate, proving it as an excellent investment choice that beats inflation and allows to accumulate more capital.

Top Characteristics of International Buyers Transactions

From August 2022 to July 2023, the total sales volume for Miami real estate reached $5.1 billion. The median price per property was $482,700, which is impressive and indicates substantial investor interest, despite the high cost of properties. Interestingly, 66% of all purchases were made in cash, an option not feasible for many investors. However, through our decentralised application, purchasing property becomes accessible starting with just $100. This opens the market to a much wider audience.

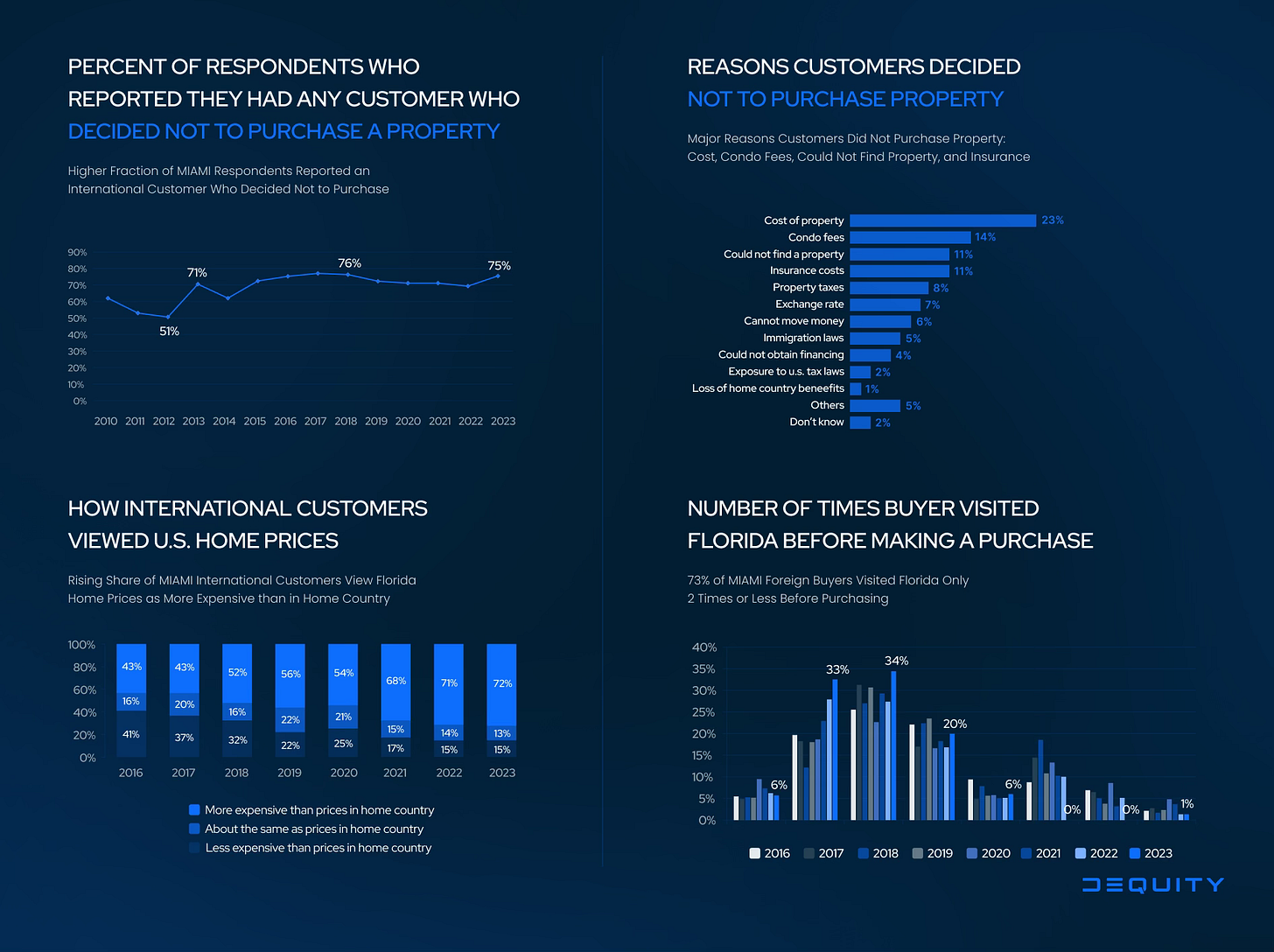

Furthermore, 59% of respondents decided not to buy property due to the high cost of real and other fees. This once again highlights the substantial demand in the market for solutions like dEquity. Utilising Real-World Assets and blockchain technology, our application offers instant access to the market, mitigates the challenges of intermediaries, reduces bureaucratic hassles, and eliminates the need for large capital.

The Largest U.S. Foreign Buyers Market

Florida is the top U.S. destination for foreign buyers, making up 23% of their transactions. From August 2022 to July 2023, foreign buyers bought $5.1 billion worth in 6,200 transactions. This represented 18% of total sales volume, compared to 2% nationally, once again proving Miami as one of the top investment destinations.

Global Interest in Miami Real Estate

People worldwide consider Miami an excellent destination, both for vacationing and to reside. The image below displays 52 countries with an interest in acquiring Miami property. The leading contingent originates from the Latin America region, with Colombia leading the pack (holding a 14.7% share of buyers) and Argentina following closely (with a 13.7% share of buyers). Following up, we have Brazil contributing a 6.7% buyer share, Venezuela with 6.4%, and Canada closing the top five with a 6.2% share.

Why Investors Choose Not to Buy Property

It's fascinating that 73% of Miami's foreign buyers visited Florida only once or twice before acquiring their first property in the region. However, a large fraction of Miami buyers decided against investing in Miami real estate. Among the top reasons are property costs, condominium fees, insurance expenses, unfavourable exchange rates, and difficulty in finding a suitable property independently.

We've addressed these challenges by developing our application – dEquity. Users can explore and acquire properties (NFTs backed by real estate, read more in our previous article) that match their preferred yield, without intermediary fees, and they can start with as little as $100. This allows for both market appreciation and monthly rental income, enabling users to build efficient portfolios in just a few clicks. Furthermore, all performance can be monitored through the portfolio page.

Why Invest in Real Estate

U.S. property prices (including annual market appreciation) and rental income proceeds have historically outpaced inflation, making real estate an appealing investment choice. At dEquity, we've merged real estate with Web3 technology, resulting in an innovative product that enables investors to hedge against inflation, create a more capital-efficient model, and potentially grow their capital. In our recent article, we have analysed the impact of Real-World Assets technology on the industry, supported by recent Coinbase research.

Investing in income-producing real estate, particularly in the form of Real-World Assets or Assets-Backed Crypto (ABC), offers significant benefits such as portfolio diversification, low correlation with public markets, reduced volatility, steady cash flow, and long-term market appreciation.

About dEquity

dEquity is a platform where income-producing real estate is just a few clicks away! Starting at just $100, we provide everyone the chance to experience the benefits of owning real estate-backed assets, such as ABC (Assets-Backed Crypto), offering passive income, inflation hedge and market appreciation.

Learn more about dEquity: Website | X (Twitter) | Substack | Telegram Announcements | Telegram Chat | Discord