Introducing ABC or Asset-Backed Crypto

Setting New Market Standards

Introduction

The world has undergone significant transformations over the past few decades. From the first web revolution to the rise of mobile apps and social media, we find ourselves once again at a point where the digital world is experiencing another paradigm shift. This shift extends beyond technology; it is reshaping economics giving rise to new financial tools and opportunities.

Citigroup predicts that blockchain-based tokenization of physical assets will be the next big application, anticipating a market worth of $4 to $5 trillion by 2030.

A new type of digital assets backed by real-world assets

ABC is a new type of asset that represents digital rights to ownership (or any other rights) for real-world assets, meeting three major criteria - full compliance, minimal risk of asymmetric information, and thin management layer.

ABC is not cryptocurrency in the common sense; rather, it is a fresh approach to finance and real-world assets. This stands apart from the grey area of the crypto market.

Full Compliance

ABC are fully compliant in terms of the flow of capital, legal matters, and regulations. ABC can be compared to stablecoins like USDT or USDC – these assets are backed by real-world assets such as US Treasury bonds, cash, or cash equivalents, and it can be easily withdrawn or converted to fiat via KYC/AML procedures. At the same time, ABC are represented in a digital form on blockchain which means they can be used in DeFi and be utilised in a more capital efficient way.

Minimal risk of asymmetric information

The ABC assets rely on blockchain technology which helps to reduce information asymmetry by providing a decentralised, and transparent platform and fully regulated framework for all operational activity. Thus, reducing risk of disinformation, loss of value, and potential fraud for all parties.

Thin management layer

ABC assets are characterised by a thin management layer reducing the amount of third parties involved in management, reducing the amount of administrative work, and simplifying governance processes for stakeholders. ABC assets are governed in a transparent and accessible manner, providing clear and reliable information for all participants.

Furthermore, ABC implements a comprehensive governance structure that protects the rights of minorities. In a nutshell, it’s an easier membership and way of participation in corporate governance.

USDT as an ABC asset

ABC can be compared to stablecoins like USDT or USDC, which are issued against US Treasury bonds, cash or cash equivalents, but instead ABC are backed with real-world assets such as income producing real-estate, cash, etc.

Similar to stablecoins, asset-backed crypto provides stability and can be easily converted to fiat currencies. In fact, ABC can be withdrawn from circulation in exchange for cash or its equivalents through legal procedures that involve Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols. This compliant process ensures transparency and regulatory adherence in the conversion of ABC to fiat currencies.

All USDT stablecoins are pegged 1:1 to US dollar, meaning that all users get the same value without a risk being exposed, meaning there is no asymmetry information for all participants.

Lastly, thin management layer that can also be applied to Tether, as all circulation supply is managed by Tether company when it comes to issue or withdrawing, or managing the USDT tokens. All circulated supply on different blockchains don’t require any extra management from users or developers – eliminating the need for a long chain of intermediaries to be involved in governance and so on.

One more ABC example – Miami real estate

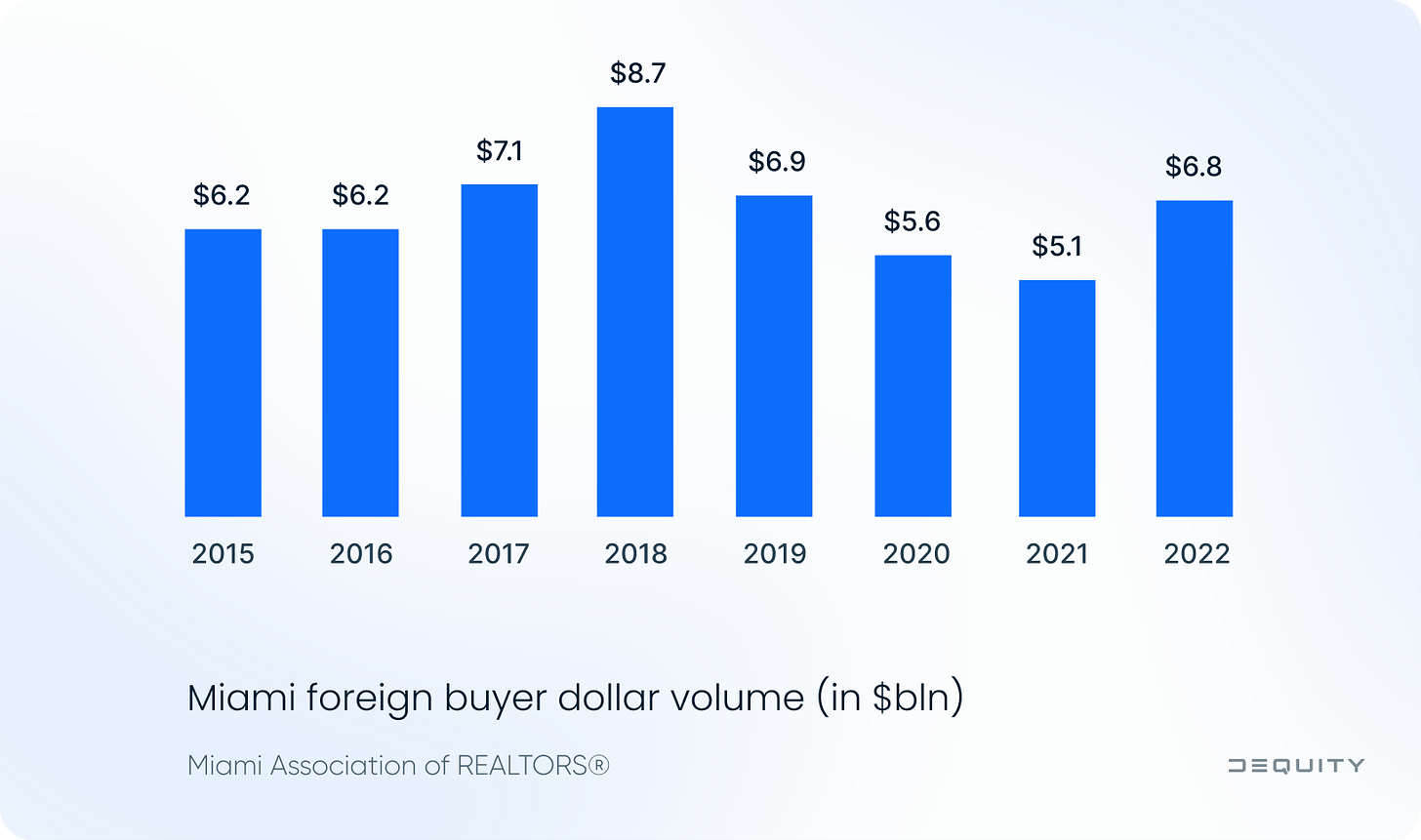

Miami real estate is known as one of the top destinations to invest money for investors around the globe, and it has an impressive return rate due to various factors. In 2022, Miami experienced a 34% growth in residential purchases from foreign buyers in terms of dollar volume, with investments totaling over $6.8 billion.

However, Miami real estate can serve as collateral for ABC assets. Furthermore, ABC able to represent and prove a digital ownership of an apartment or a fraction of it as well as earning interest rates on rental fees.

For instance, long-term rent of residential apartments is quite common in Miami. This practice is clearly regulated, governed by shareholders, and properties are managed by third parties under a maintenance contract, all of these are met with the three main criterias of ABC assets.

In the next article, we’ll elaborate further on how dEquity leverages all advantages over ABC assets. Discuss the dEquity ABC real-estate investment platform, how does it work and why it’s a completely new approach to the investment.

About dEquity

A platform where income-producing real estate is just a few clicks away! Starting at just $100, we provide everyone the chance to experience the benefits of owning real estate-backed assets, such as ABC (Assets-Backed Crypto), offering passive income, inflation hedge and market appreciation over time.

Learn more about dEquity:

Website | X (Twitter) | Substack | Telegram Announcements | Telegram Chat | Discord